Invoice Factoring for Small Businesses: What It Is & How It Works

When you’re running a small business, delayed customer payments can turn into a major cash flow problem. You've done the work and sent the invoice, but the payment may not land for another 30, 60, or 90 days. That’s where invoice factoring for small businesses comes into play.

Instead of waiting, factoring gives you access to the money tied up in unpaid invoices so you can keep growing without the cash crunch. This guide breaks down what invoice factoring is, how it works, and why so many small businesses turn to it to help them grow.

What Is Invoice Factoring?

Invoice factoring is a financial service that allows businesses to sell their outstanding invoices to a third-party company—called a factoring company—in exchange for immediate cash. Rather than waiting for your customers to pay, you get most of the invoice value upfront, and the factoring company collects payment directly from your customers later.

How Invoice Factoring Works (Step by Step)

The invoice factoring process can vary slightly depending on the factoring company and the industry, but it usually follows a clear pattern, such as the following:

- You provide goods or services to your customer and send an invoice.

- You sell the invoice to a factoring company.

- The factoring company advances a percentage of the invoice value to you (usually 80–95%).

- The customer pays the factoring company directly when the invoice is due.

- You receive the remaining balance, minus factoring fees.

This process repeats as you continue issuing and factoring new invoices. It’s a flexible model that scales with your sales volume and can be used as needed. Here's a real-world example:

.jpg)

Benefits of Invoice Factoring Services for Small Businesses

For many small businesses, factoring isn’t just a short-term fix. It’s a strategic financial tool. Here are a few key benefits:

- Improved cash flow: You don’t need to wait 30+ days to get paid.

- No added debt: Unlike a loan, factoring doesn’t increase your liabilities.

- Allows you to focus on growth: With steady cash flow, you can take on a larger jobs or new customers.

- Outsourced collections: The factoring company handles payment tracking and follow-up.

Industries like transportation, staffing, manufacturing, and business services often use invoice factoring services to keep operations moving, even when customers are slow to pay.

Choosing the Best Invoice Factoring Company for Your Needs

Not all invoice factoring companies offer the same terms or levels of service. If you’re considering factoring for your business, take time to evaluate your options based on the following:

- Advance rate: What percentage of the invoice will you receive upfront?

- Fee structure: Are the fees flat, tiered, or based on time outstanding?

- Customer interaction: Will your customers know you’re using a factoring service?

- Contract terms: Are you locked into a long-term contract, or can you factor as needed?

Some factoring companies also offer value-added services, like credit checks, collections support, and integrations with your invoicing or accounting software.

Pro tip: Choose a factoring partner that understands your industry and offers transparency from day one. A good provider should feel like an extension of your team.

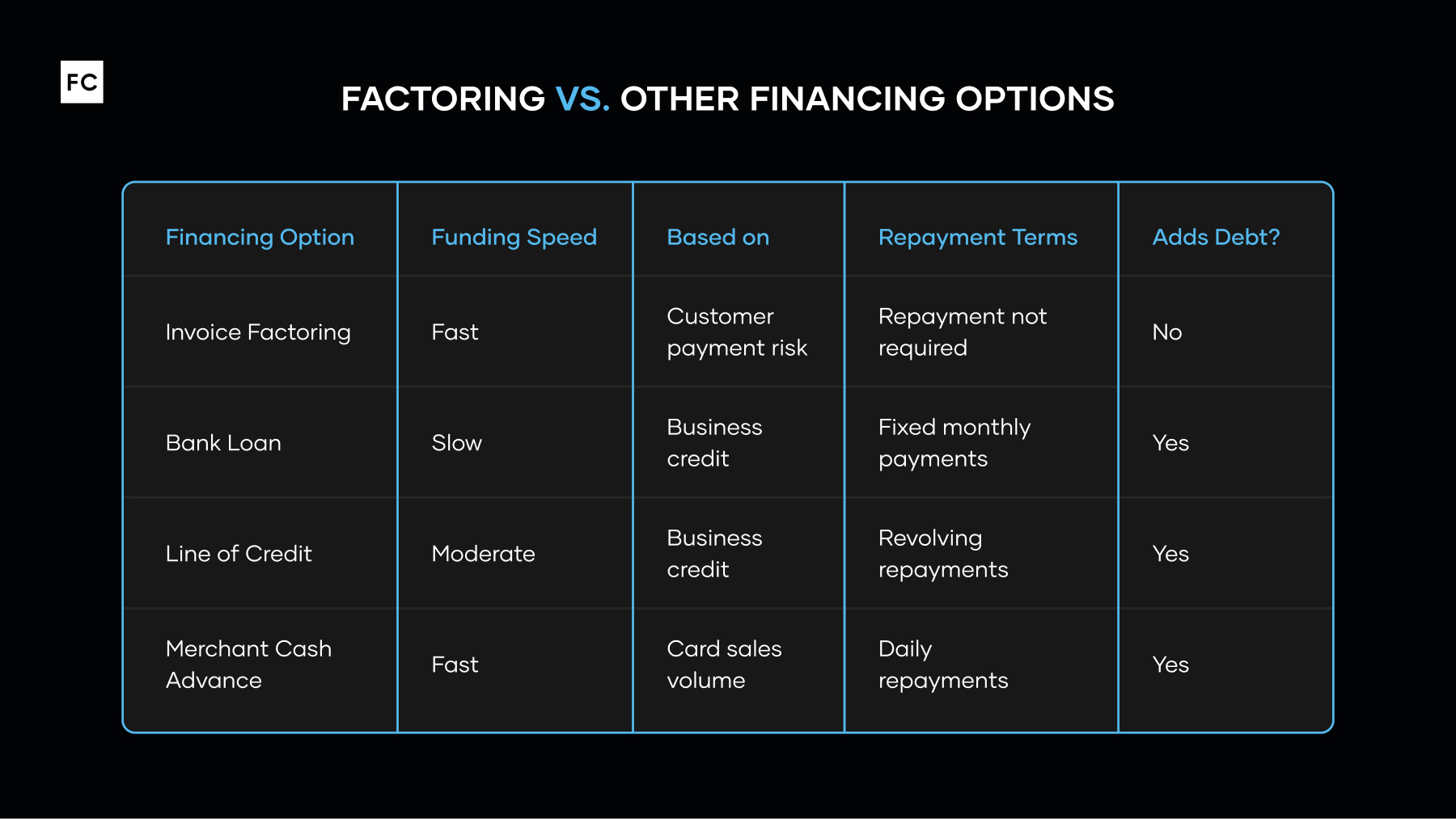

Factoring vs. Other Financing Options

You might be wondering how factoring compares to other options like loans, lines of credit, or merchant cash advances. Here’s a quick breakdown:

For businesses that invoice other companies and need cash to keep moving, invoice factoring is often the most flexible, low-risk option.

Getting Started With Invoice Factoring

If you're exploring factoring for the first time, here are a few tips to start off strong:

- Have clean, consistent invoicing practices

- Make sure your customers are aware of the factoring relationship

- Look for software or platforms that automate the invoice factoring process

- Stay organized, as factoring works best when your documentation is solid

Many small businesses use factoring to bridge the gap between invoices and payments—especially when cash flow gets tight or opportunities for growth arise.

Ready to Modernize the Way You Factor?

Whether you’re new to factoring or looking to upgrade your process, FactorCloud can help you move faster, stay organized, and scale with confidence. Our software makes the invoice factoring process easier by automating schedule creation, integrating collections, and offering a full suite of reporting tools designed for factoring companies of all sizes.

Schedule a demo to see how FactorCloud can help streamline your factoring operations.