The Hidden Costs of Manual Supply Chain Financing

Supply chain financing helps businesses unlock cash flow by turning unpaid invoices into working capital. But when the process is handled manually (through spreadsheets, email chains, and endless back-and-forth), it creates hidden costs that eat into margins and slow down growth.

It’s important to keep in mind that the process behind supply chain financing is just as important as the funding itself.

In this blog, we’ll break down the real costs of manual workflows in supply chain financing, highlight common invoice factoring challenges, and show you how automation helps factoring companies (and their clients) operate with less risk and more efficiency.

What is The Role of Supply Chain Financing in Small Business Growth?

Supply chain financing is one of the most effective ways for businesses (especially small and midsize companies) to unlock working capital without taking on traditional debt. By advancing cash against unpaid invoices, factoring companies provide a lifeline that keeps businesses moving. And for small businesses, access to cash can mean the difference between taking on new opportunities or turning them down.

Here’s why supply chain financing matters:

- It improves cash flow so businesses can cover payroll, materials, or expansion.

- It reduces reliance on loans or credit cards, which can carry higher interest rates.

- It supports growth opportunities by ensuring capital is available when it’s needed most.

But while supply chain financing can unlock new opportunities, the way it’s delivered has a big impact. If the process is slow, error-prone, or opaque, the benefits quickly diminish. That’s why the systems behind the financing matter just as much as the funding itself.

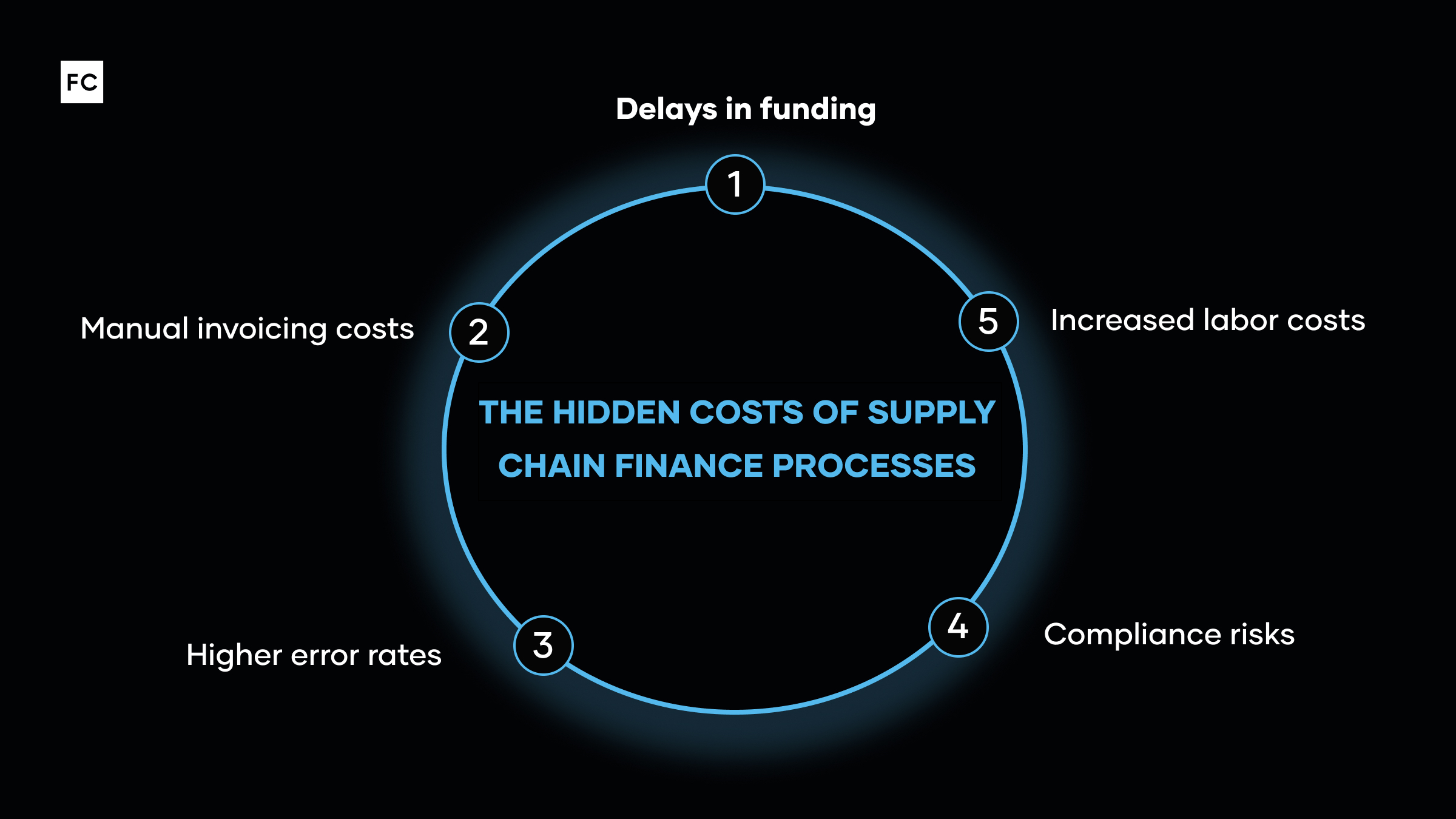

The Hidden Costs of Supply Chain Finance Processes

At first glance, spreadsheets and emails might feel “good enough” for a factoring company that’s just getting started. But manual processes come with hidden costs that add up quickly. Here are a few ways expenses can quickly add up:

- Delays in funding: Every extra day spent chasing documents or reconciling accounts means slower access to cash. For clients, delayed funding erodes trust and makes your services less competitive.

- Manual processing cost: A 2024 study found manual invoice handling costs $12.88 per invoice on average, and up to $25.

- Higher error rates: 3.6% of manual invoices contain mistakes, triggering rework and damaging trust. Even small errors can undermine confidence in your reporting and force clients to double-check your work.

- Compliance risks: Without structured, audit-ready records, your firm is exposed during audits and reviews. Compliance gaps not only create risk but also damage your reputation with lenders and investors.

- Increased labor costs: What looks like a “cheap” process quickly becomes expensive when more headcount is needed. Resources that could fuel client service or business growth are instead tied up in rework.

The reality is simple: manual processes in supply chain financing don’t scale. They drain time and money.

Invoice Factoring Challenges in a Manual World

When factoring depends on manual workflows, the friction compounds:

- Lost or delayed Notices of Assignment

- Duplicate or inconsistent invoice data

- Important documents buried in email inboxes

- Poor visibility into reserves, fees, or delinquency

- Increased fraud risk from weak verification

For small businesses depending on factoring for stability, these inefficiencies can be frustrating or even damaging. That’s why many factoring company risks come not from the funding model itself, but from the operational processes behind it.

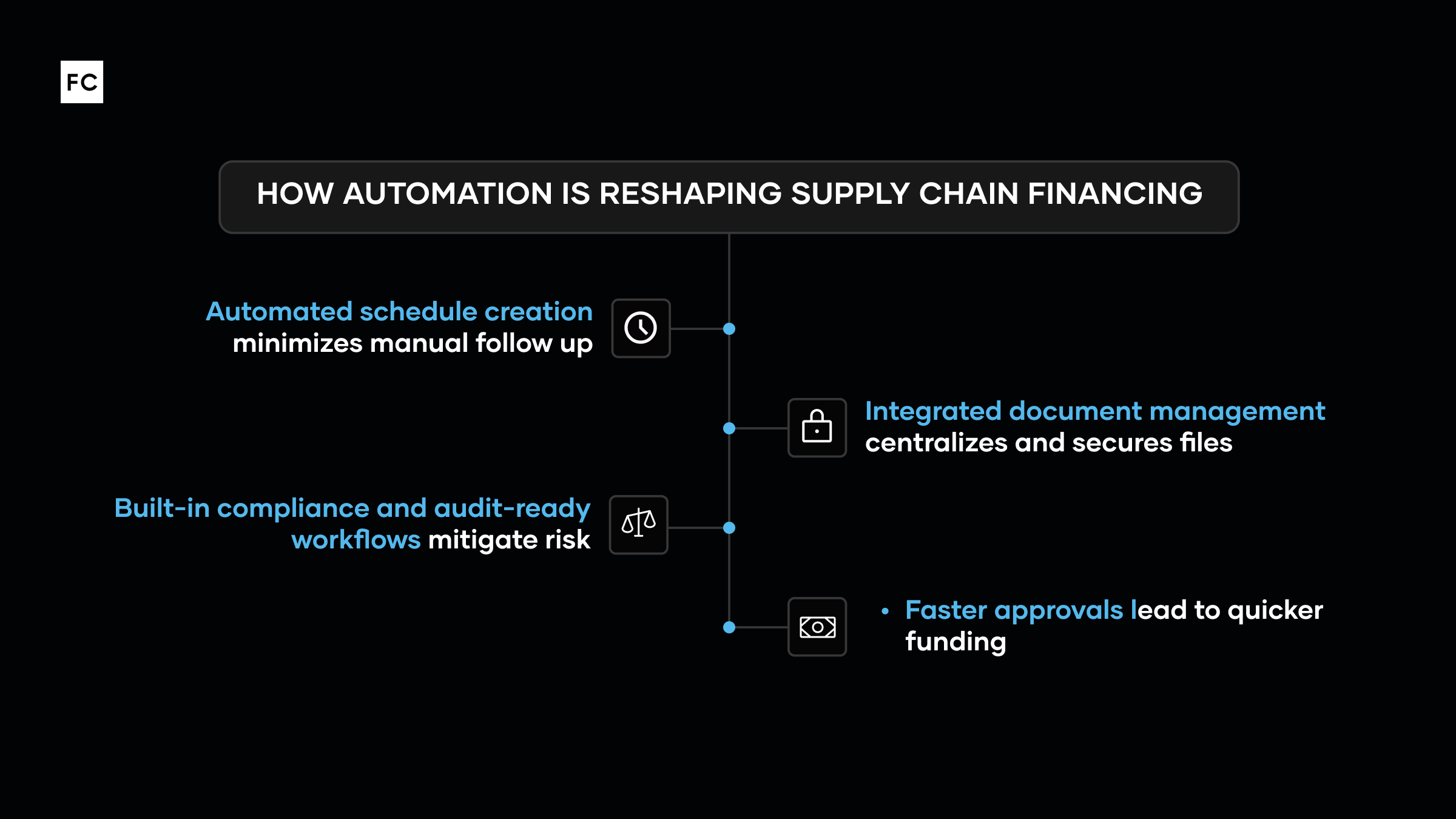

How Automation Is Reshaping Supply Chain Financing

Fortunately, factoring companies don’t have to stay stuck in manual mode. Automation transforms the supply chain finance process into a streamlined, reliable system:

- Automated schedule creation that minimizes manual follow up

- Integrated document management that centralizes and secures files

- Built-in compliance and audit-ready workflows to mitigate risk

- Faster approvals for quicker funding

Put simply, automation makes supply chain financing more efficient, secure, and scalable.

A Smarter Path Forward With Secure Factoring Services

Invoice factoring services are no longer just about providing funding; they’re about providing funding safely and efficiently. Secure financial software providers give factoring companies the tools to minimize risk, deliver a better client experience, and grow without being buried under manual work.

That’s why leading factoring companies are turning to platforms designed with compliance, security, and automation at their core—like FactorCloud. By investing in the right technology, they’re reducing the hidden costs of manual operations and protecting both themselves and their clients from unnecessary risk.

FactorCloud practices compliance and cybersecurity every day. Our platform is SOC 2 Type 2 certified, with secure workflows, 2FA, and audit-ready processes built in. That means factoring companies don’t just move faster, they move with confidence.

The Future of Supply Chain Financing Is Automated

Manual risk is not just a pain, it’s a competitive disadvantage.

Manual supply chain financing may work for a while, but the hidden costs add up quickly. Delays, errors, compliance gaps, and frustrated clients create a competitive disadvantage that most factoring companies cannot afford.

FactorCloud gives factoring companies the structure, automation, and compliance tools they need to scale with confidence. Schedule your demo today to cut error rates and save hundreds of hours every year.